Is a U.S. Stock Market Crash imminent 2015

Printed From: Avian Flu Talk

Category: Main Forums

Forum Name: General Discussion

Forum Description: (General discussion regarding the next pandemic)

URL: http://www.avianflutalk.com/forum_posts.asp?TID=30204

Printed Date: April 27 2024 at 7:00pm

Topic: Is a U.S. Stock Market Crash imminent 2015

Posted By: Medclinician2013

Subject: Is a U.S. Stock Market Crash imminent 2015

Date Posted: October 08 2013 at 10:28am

|

http://www.dailymotion.com/video/x15p7gh_what-are-the-odds-of-a-stock-market-crash-on-oct-9_news - http://www.dailymotion.com/video/x15p7gh_what-are-the-odds-of-a-stock-market-crash-on-oct-9_news Predictions are beginning once more as the partial U.S. government shutdown continues that there will be a major hit on the Stock Market. Years later - August 24, 2015 - http://%20www.foxbusiness.com/markets/2015/08/24/wall-street-set-to-plunge-amid-global-market-selloff/%20?intcmp=hpbt1 - http://www.foxbusiness.com/markets/2015/08/24/wall-street-set-to-plunge-amid-global-market-selloff/?intcmp=hpbt1 It was a long time coming with many warning along the way. We can only hope this will correct itself very soon - but the Dow has plunged more than a thousands points and all other indicators are in correction areas. Worried about the serious issues with China and other worldwide markets - Japan- are disturbing stock holders. Medclinician ------------- Medclinician - not if but when - original |

Replies:

Posted By: Guests

Date Posted: October 08 2013 at 10:38am

|

I think a 20% - 30% correction could be a little modest, but yes, it appears that a significant crash could be imminent very soon. http://blogs.marketwatch.com/thetell/2013/10/07/a-one-month-shutdown-risks-triggering-20-to-30-correction-barry-ritholtz/ |

Posted By: Medclinician2013

Date Posted: October 08 2013 at 10:45am

|

Thank you, Albert. I was a bit hesitant to even post this thread. But here is some right now information... http://econintersect.com/b2evolution/blog5.php/2013/10/08/market-commentary-averages-tank-after-obama-speaks" rel="nofollow - http://econintersect.com/b2evolution/blog5.php/2013/10/08/market-commentary-averages-tank-after-obama-speaks I hope my dates hold up as well as the source. Med ------------- Medclinician - not if but when - original |

Posted By: Guests

Date Posted: October 08 2013 at 12:18pm

|

He's still speaking at this moment. He probably won't stop until the market is down a little further. Obama needs the markets to tank in order to get talks going once again. A pretty pathetic game being played in Washington. |

Posted By: Turboguy

Date Posted: October 08 2013 at 1:32pm

Modest? That's well in circuit breaker range. If it drops that much over a short amount of time, we're going to see bigwigs jumping out of windows! ------------- Liberals claim to want to give a hearing to other views, but then are shocked and offended to discover that there are other views. - William F. Buckley |

Posted By: Medclinician2013

Date Posted: October 08 2013 at 3:05pm

|

Here is the latest. The networks are jumping on after that was posted. http://money.cnn.com/2013/10/08/investing/stocks-markets/index.html?hpt=hp_t2" rel="nofollow - http://money.cnn.com/2013/10/08/investing/stocks-markets/index.html?hpt=hp_t2 Tech stocks crushed as debt deadline loomsIt's time for a dialog. ------------- Medclinician - not if but when - original |

Posted By: Guests

Date Posted: October 08 2013 at 4:40pm

|

Dang, I am waiting for a crash...then I will invest! Hate to tell you all but this political stuff is all theater. |

Posted By: jacksdad

Date Posted: October 08 2013 at 6:03pm

Too much drama, poorly written script, and the cast stinks  ------------- "Buy it cheap. Stack it deep" "Any community that fails to prepare, with the expectation that the federal government will come to the rescue, will be tragically wrong." Michael Leavitt, HHS Secretary. |

Posted By: Kilt2

Date Posted: October 08 2013 at 8:00pm

|

No question. The US Stock market entered a Secular Bear market and Post Bubble economy in 2000 which means the market falls for 20 years. The PE10 is a graph which is indicative of the beginnings and ends of Secular markets ans when the level gets to 7 or 5, the new secular bull market is born. At the moment the PE10 is around 23, so it has to halve and halve again. In other words since the year 2000, the market will do nothing but crash and crash and crash till the PE10 gets to 5. Read Irrational Exuberance by Robert Shiller. Its all there. We ignore history at our peril. ------------- And I looked, and behold a pale horse: and his name that sat on him was Death, and Hell followed with him. |

Posted By: Turboguy

Date Posted: October 09 2013 at 1:02pm

Zer0 said that by raising the debt ceiling we wouldn't be putting ourselves in any more debt. I am truly astonished that he knows so little of how the economy works. Raising the debt ceiling *EXACTLY* drives up the debt and balances the budget instantly.

Furthermore, if we default, it is because Zer0 wanted to do so. They take in more than enough in revenue to not default if they simply prioritize, which they do anyway. All the debt ceiling does is forces our bloated government to stop borrowing and live within their means. They'll either have to cut spending, and I can think of quite a few entitlement programs, 0bamaphones, welfare, foodstamps and 0bamacare that could easily be cut, or raise taxes significantly. Knowing this dumbass, he's stupid enough to pile on the taxes.

You know, instead of only doing what government is supposed to do. ------------- Liberals claim to want to give a hearing to other views, but then are shocked and offended to discover that there are other views. - William F. Buckley |

Posted By: Satori

Date Posted: October 09 2013 at 2:05pm

|

I find it quite interesting that people complain endlessly about the cost of "entitlement programs" for the poor and middle class what about the entitlement programs for the wealthy and corporations ??? money spent on the poor and middle class pales into comparison to that spending example when Rumsfeld was Sec of Defense he finally admitted that the Pentagon couldn't account for two TRILLION dollars of spending we're still buying $500 toilet seats and still spending $50 for a screw that ya can get at a hardware store for 50 cents |

Posted By: Medclinician2013

Date Posted: October 10 2013 at 6:33am

Posted By: EdwinSm,

Date Posted: October 10 2013 at 7:47am

|

Today the markets are up - over 1% in the USA when I just checked and better in Europe. So maybe it won't crash today! I think the markets are overvalued, but I would hate to see a crash as that would cause a lot of pain to a lot of people. I would like to see a gradual slide to more "realistic" levels. Investors seem to run in herds so they might still pile into the markets for a bit before all turning at about the same time - so just this behaviour seems to make a crash more likely. |

Posted By: Medclinician2013

Date Posted: October 10 2013 at 9:38am

|

http://money.cnn.com/2013/10/10/investing/stocks-markets/index.html?iid=Lead&hpt=hp_t1" rel="nofollow - http://money.cnn.com/2013/10/10/investing/stocks-markets/index.html?iid=Lead&hpt=hp_t1 The key phrase here is... Stocks soar. The graph is magnified so the difference with a 1.57% jump after days of 1% drops is not that impressive. Statements that they might reach a deal which is a bandage over a serious wound will not fix the U.S. Economy. If you wade past the eye popping graph and headline, the contents of the article and what is happening are not that encouraging. Unemployment edging up? Investors saw one sign that should make them uneasy about the jobs market in the U.S., but they seemed content to ignore it Thursday. The U.S. Labor Department's weekly report on http://money.cnn.com/2013/10/10/news/economy/unemployment-benefits/index.html?iid=EL" rel="nofollow - initial jobless claims

showed a sharp jump in claims over the previous week. The government

did not release its monthly jobs report last week due to the shutdown. The world markets however jumped as well on a global scale. http://money.cnn.com/data/world_markets/europe/?iid=EL" rel="nofollow - http://money.cnn.com/data/world_markets/europe/?iid=EL This would show us how really volatile the market is when a single news release can produce such a change that was the reason for the encouraging market results so far today. To end on a more positive note, no one wants to see the stocks tumble or economic disaster. This is not entirely true though. Some could make a sizable killing on buying as they bottom out and then rebound. Yet, over all, a better economy and recovery for the U.S. is a plus not only for America, but for global financial stability as well. Yet there are certain realities in place. One indicator you might look at to understand what is driving the market now is the fear-and-greed index. This partially explains why the American economy is in trouble and how it got there. http://money.cnn.com/data/fear-and-greed/?iid=EL" rel="nofollow - http://money.cnn.com/data/fear-and-greed/?iid=EL The components or elements involved will not change in a day. As one poster said, this has been going on for many many years. But as we veterans often say - "a day above ground is a good day." So, it appears today in the Stock Market for most, was a good day. Med ------------- Medclinician - not if but when - original |

Posted By: Turboguy

Date Posted: October 10 2013 at 1:38pm

It's because the rumor on the street is that QE I, II, III, IV, V, VI, VII will continue and the Republicans are going to fold any day now and give Zer0 exactly what he wanted in the first place.

If they fold, they're done. This is high stakes poker and if the Republicans aren't 100% ready to push all their chips into the middle and say, "Screw you, Zer0, we're not going to do it your way!" they deserve the blame they were going to get anyway and shouldn't even be there. Zer0 knows this, the question is: Is Zer0 ready to skip the debt limit to crash the economy with his signature disasterous piece of legislation? Call his bluff. If the Orange Boner doesn't have the cajones to actually pull it off, then why the hell did you push it this far?

The debt ceiling only works because those that are going to have to pay for it HAVEN'T BEEN BORN YET and don't get to vote! I mean, if they're just going to keep raising the debt ceiling, then why have the damned thing in the first place? Let's just borrow to infinity and inflate our way to prosperity! ------------- Liberals claim to want to give a hearing to other views, but then are shocked and offended to discover that there are other views. - William F. Buckley |

Posted By: jacksdad

Date Posted: October 10 2013 at 2:18pm

Orange Boner...    ------------- "Buy it cheap. Stack it deep" "Any community that fails to prepare, with the expectation that the federal government will come to the rescue, will be tragically wrong." Michael Leavitt, HHS Secretary. |

Posted By: Medclinician2013

Date Posted: October 11 2013 at 11:13am

|

They are not out of the woods yet. Despite a glowing report i.e. http://finance.yahoo.com/news/stock-market-news-october-11-124040212.html" rel="nofollow - http://finance.yahoo.com/news/stock-market-news-october-11-124040212.html On Thursday, Republicans leaders said they would vote to raise the country’s debt limit for six weeks. A spokesman for President Barack Obama said that the president will possibly sign a bill to raise the country’s borrowing limit. Fifteen minutes before the closing bell, Senate Majority Leader Harry Reid said Democrats will not hold discussions with Republicans until partial government shutdown is lifted. However, Harry Reid’s discouraging comments didn’t affect yesterday’s trading session. So, timing was extremely significant in terms of the Market's behavior yesterday and the overall problems that could still drive it down are still there. A one day rally on the bases of conflicting interpretation of a single meeting is hardly a sign things are okay. This remains a watch and wait situation and raising the debt limit without reopening the government or agreeing to a solution which is only for a few weeks, is not enough to relieve the tension. It is little more than a band-aid over a serious wound which has developed over decades. A well developed strategy is relying on the American public's cumulative memory loss when it comes to huge negative events over time. In this case, it is the belief that once the government opens, everything will be back to normal including the stock market. This is very unlikely. The overall perception of U.S. economic reliability and solid ability to pay the debt and their obligations has been shaken. This could play out over a much longer time in which the financial global balance shifts (as it has been shifting for decades) and the continued outsourcing of manufacturing and loss of jobs and money flooding outward will impact the stocks and economy. Day by day - just as we live our lives. Medclinician ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: October 14 2013 at 10:24am

|

http://www.nasdaq.com/article/stock-market-news-for-october-14-2013-market-news-cm287020%20" rel="nofollow - http://www.nasdaq.com/article/stock-market-news-for-october-14-2013-market-news-cm287020 On the home front, the Thomson Reuters/University of Michigan reported consumer sentiment numbers. The preliminary consumer sentiment index fell to 75.2 in September from previous month's final reading of 77.5. This was marginally below the consensus estimate of 75.6. The consumer sentiment touched a nine-month low due to investor concerns about the partial government shutdown and the approaching debt ceiling deadline. Comment: It is amazing that the stocks continue to stay up considering there has been no real hard core improvement aside from bills from both parties that lack solid numbers and there is no apparent real bottom line agreement. Despite the news stories which in later portions of the articles mention that there are still differences and it could take longer to hammer them out. As mentioned in another post, there is always the chance of some Senate or Congressional bill passed, however temporary, which will be reflected in a true surge in the Market. If the 10/17/2013 is reached and there is a default, then the stocks may drop drastically. The closer America gets to that date with no agreement, the more imminent a likely crash is. One day at a time; hoping the fighting representatives of the American people can set aside their political agendas to save the United States economy. Medclinician ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: October 16 2013 at 2:50am

|

There is no agreement in either Congress or the Senate as we approach a default at midnight tonight. The market is spooked and falling. http://www.money.cnn.com/2013/10/15/investing/stocks-markets/index.html?hpt=hp_t2" rel="nofollow - http://www.money.cnn.com/2013/10/15/investing/stocks-markets/index.html?hpt=hp_t2 U.S. stocks ended in the red Tuesday as lawmakers in Washington continued to wrangle over a budget deal.The major indexes started the day slightly lower and a sell-off accelerated in afternoon trading. The http://money.cnn.com/data/markets/dow/?iid=EL" rel="nofollow - Dow Jones Industrial Average dropped more than 100 points, or nearly 1%, and the http://money.cnn.com/data/markets/sandp/?iid=EL" rel="nofollow - S&P 500 fell 0.7%. It was the first decline in five days for both indexes. The http://money.cnn.com/data/markets/nasdaq/?iid=EL" rel="nofollow - Nasdaq declined 0.6% following three straight days of gains. Senate leaders had said earlier Tuesday they made "tremendous progress" toward an agreement to end the partial http://economy.money.cnn.com/2013/10/11/shutdown-week-2-still-hurts/?iid=EL" rel="nofollow - government shutdown and raise the http://money.cnn.com/2013/10/14/news/economy/debt-ceiling-crisis/index.html?iid=EL" rel="nofollow - debt limit , but hopes were starting to evaporate following reports that talks to boost the debt ceiling may be falling apart. comment: Basically they are running out of time. They don't meet until noon today and the odds of getting bills passed and getting support is looking bad. Statements from the leaders and speakers are not considering they cannot control the votes and guessing whether new bills will pass is not based on anything concrete. No one wants this, but at this point people should be prepared if the unthinkable happens - we default. This would slam dump the credit and send the Stock Market spiraling down. Government has never been fast at anything. 21 hours and 11 minutes left. Medclinician ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: October 16 2013 at 10:57am

|

http://www.investors.com/stock-market-today/" rel="nofollow - http://www.investors.com/stock-market-today/ Stocks opened strongly and held gains Wednesday, cheered by a bipartisan deal in the Senate that will reopen the government through Jan. 15 and lift the debt ceiling through Feb. 7. About three-and-a-half hours into the session, all three major averages scored gains of better than 1%. The Nasdaq hit a 52-week high, while the S&P 500 came to within 8 points of a record. Preliminary data showed NYSE volume tracking 16% higher than Tuesday. Nasdaq volume rose 4%. We have approximately 13 hours left. This is the final countdown to a default on our economy which still must make it through the holidays and possible Draconian cuts should there be no funds by November 1st. Conclusion: Despite all the doomsday talk, the common person in the U.S. does not want to see the economy crash. The world as well would be massively effective and would likely suffer plunges as well or surges depending on what happens here. Medclinician ------------- Medclinician - not if but when - original |

Posted By: hachiban08

Date Posted: October 16 2013 at 11:06am

I thought it was based on Midnight, EST? That'd be more like 10 hours left. Guess we'll see what happens. My friend is an investment consultant down in San Diego, and he said his clients are still spooked on what's to come next. ------------- Be prepared! It may be time....^_^v |

Posted By: coyote

Date Posted: October 16 2013 at 11:25am

Both sides are useless!! We do not have to Default or even worse raise the Dept ceiling!! Just cut out all the wasteful spending!!  They are all a bunch of XXXXXXXX Playing with our Lives. They are all a bunch of XXXXXXXX Playing with our Lives.POLITICO @politico 41 s Senate expected to vote on a deal late Wednesday afternoon or early evening, Dem leadership aide says: [link to politi.co] ------------- Long time lurker since day one to Member. |

Posted By: coyote

Date Posted: October 16 2013 at 11:53am

|

Maybe this is their grand plan... The House Republicans have too much too lose if they pass this bill.Nobody will ever take them serious ever again in anything they say. The most logical thing for the House to do is NOT vote for this bill. If we default everyone will be blamed not just the republicans. ------------- Long time lurker since day one to Member. |

Posted By: Medclinician2013

Date Posted: October 16 2013 at 7:44pm

|

It may seem stock market problems are now history - but they really aren't. The bill is on the Congressional floor right now and they are debating it. One can hope,for the American people, that tomorrow morning will see a huge surge and for awhile we will be out of trouble. Yet this is a band-aid over a serious wound, and the Market is very subject to change. At midnight, EST, the story will be told.  ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: October 24 2013 at 9:43am

|

http://www.youtube.com/watch?v=GPYLJoq_40Y" rel="nofollow - https://www.youtube.com/watch?v=GPYLJoq_40Y The tail wags the dog. Why does the dog wag its tail? Because the dog is smarter than the tail. If the tail were smarter, it would wag the dog. Medclinician ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: November 07 2013 at 12:16pm

|

http://money.cnn.com/data/us_markets/ - http://money.cnn.com/data/us_markets/ Nov 07 1:28pm: Many stocks were in the red Thursday There is news of a massive decrease in social security checks in December 2013 - as a mandatory 3 months of premiums is taken out in a lump sum. This could possibly devastate the poor and elderly across the board and give some incomes of $26-40 dollars as compared to hundreds or more. It was difficult to get the real numbers except on CNN which appears more interested in the drop in Tesla and a rise in Twitter versus a jittery market. The effect on Americans is a non-negotiable reality with a massive short fall income due to Obamacare. No money will go back into pockets once it is taken out. This massive blow will hit just before Christmas and could send the markets spiraling globally at the same time the flu begins to spread. The reopening of the government solved nothing in terms of the rocky economic reality which will hit January 1, 2014. The ripple effect as Americans literally will not be able to afford affordable health care, the hit on the economy will hit the retailers hard. Prepping sounds like a really good idea. Medclinician ------------- Medclinician - not if but when - original |

Posted By: ParanoidMom

Date Posted: November 07 2013 at 3:42pm

|

I agree. Nothing was solved, it was just delayed. One of these times there won't be a ceiling to raise and it's going to go down hill fast! ------------- But the souls of the righteous are in the hand of the Lord Wisdom of Solomon 3:1 |

Posted By: Medclinician2013

Date Posted: November 29 2013 at 9:53am

|

The over all mood in the U.S. concerning a coming crash of the economy is becoming more and more pessimistic. While Wall Street and the financial community continue to rave about the Dow Jones and other classic numbers to watch to determine the health of the Stock Market, these may not truly reflect it's future. The classic and better indicator of the overall mood of the U.S. and and world as to how things are often polls. A lack luster November with multiple issues during Thanksgiving, may begin another fall in the Stock Market. Today is Black Friday as shoppers swarm the stores the economy and their mood will be reflected in the sales. CNN/ORC today said that people are getting gloomier about the future of the economy.

November 29th, 2013

06:00 AM ET

And a http://i2.cdn.turner.com/cnn/2013/images/11/29/cnn.orc.poll.economy.pdf - CNN/ORC International survey released Friday also indicates that less than a quarter of the public says that economic conditions are improving, while nearly four in ten say the nation's economy is getting worse. http://politicalticker.blogs.cnn.com/2013/11/29/cnnorc-poll-jump-in-percentage-of-those-saying-things-not-going-well/?hpt=hp_t2 - http://politicalticker.blogs.cnn.com/2013/11/29/cnnorc-poll-jump-in-percentage-of-those-saying-things-not-going-well/?hpt=hp_t2 Yet this lost faith in the economy seems not to be affecting the New York Stock Exchange. http://www.marketwatch.com/ - http://www.marketwatch.com/ Have we reached a point where we could have a truly bad economy with stock numbers at an all time high? Is this possible? Could growing poverty, bad health care, not touch many of the rich who have large stock holdings, while there are some low interest rates? These rises in values for top companies do not reflect the tragedy of massive layoffs to maintain profits, outsourcing much of the work overseas, and reducing or wiping out retirement benefits. Food for thought. So perhaps we should look to other indicators to tell us if an economic crash is still coming and the Stock Market will only collapse after it has already happened. Medclinician ------------- Medclinician - not if but when - original |

Posted By: Guests

Date Posted: November 29 2013 at 4:21pm

|

The stockmarket is going crazy because of excess liquidity being pumped into the market by the Fed. AKA money printing The theory goes pump like crazy until the economy picks up. Then pay down the debt later. There are many problems with this idea. Things like artificially inflating everything ie property, stocks etc etc. This leads to inflation, which erodes the real economy. I'm getting out of the stock market now as i see it hitting a brick wall soon.

|

Posted By: Medclinician2013

Date Posted: November 30 2013 at 4:36am

|

Perhaps as we reach the last day of November and a self-imposed deadly for the .gov Obamacare website, as many of us will see our SSI checks cut by 80% for this month, things will hit the fan. With millions who may be left with as little as $50 to pay for all their bills and food this will certainly not increase their ability to buy presents for Christmas. This, as many threads I post here, is not a fun task. It is simply making people aware of the situation so they can prepare. Thank you posters who, many of whom are very knowledgeable about stocks, Wall Street, and have many years of experience. Your wisdom has guided my journey into an area that I continue learn about and try to understand. I write for the common person who has little experience or knowledge in this area and write in in simple words. If, and it is likely, things hit the fan today, and the roll-out is poor and people are truly upset, it may affect the Stock Market considerably. Perhaps it won't crash, but the honeymoon may be over as forces which have worked to reflect a Bull Market falter and a Bear Market replaces the house of cards which sits so precariously aloof as the storm approaches. http://content.moneyinstructor.com/693/what-bull-bear-market.html - http://content.moneyinstructor.com/693/what-bull-bear-market.html ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: December 05 2013 at 10:12am

|

http://finance.yahoo.com/news/stock-market-news-december-5-144752550.html - http://finance.yahoo.com/news/stock-market-news-december-5-144752550.html The Dow and S&P 500 extended their losing streak into a fourth successive day as strong private sector labor data intensified apprehensions that the Federal Reserve would soon begin trimming its economic stimulus package. Stocks traded lower for most of the session before make up for some losses ahead of the closing bell. The prevailing mood of uncertainty meant that there was little trading action as investors await key nonfarm payroll data to be released on Friday. The materials sector was the biggest gainer among the S&P 500 industry groups while industrials lost the most. http://www.reuters.com/article/2013/12/05/us-markets-stocks-idUSBRE9AS0ER20131205 - http://www.reuters.com/article/2013/12/05/us-markets-stocks-idUSBRE9AS0ER20131205 (Reuters) - U.S. stocks edged lower on Thursday after a round of mixed economic data left traders guessing how soon the Federal Reserve would begin to wind down an asset-purchase program that has helped equities rally. comment: As money is pumped into areas which artificially have indicated economic stability, the Stock Market-- as it has always been-- is taking a hit by recent political disasters. Many economic agreements including those with farmers who are heavily subsidized and even corn and grain--could almost double some prices will as well -- in the near future. The price of milk is likely to double to $7 a gallon and there will be other increases as well. As these sweep through the supermarkets, they will inflate other prices of anything using milk or dairy products. That would include cheese, yogurt and things we have grown to need to sustain our basic health. Despite control mechanisms in place to stop a crash, people still basically influenced by emotion, could panic. However, high tech electronics and auto sell or buy devices in place to handle high speed trading, will contribute to a crash,if it happens, independent of human emotions. As so many other things are happening, no one wants this and we will continue to see an overrated market as the foundations supporting the economy are being eaten away. Medclinician ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: December 26 2013 at 3:54pm

|

For history I will say this. There is no logical reason for a stock market surge. With the coming of cuts in food stamps, veteran's benefits, and the most unworkable health care plan ever written these numbers being pumped out are the biggest lie of all. This thread will sink and be forgotten, but the stocks will not stay up when it hits the fan. Congress is the worst it has ever been, and the sane will eventually will stop feeding the flames. Never have the American people been so deceived so much for so long. Medclinician ------------- Medclinician - not if but when - original |

Posted By: DANNYKELLEY

Date Posted: December 26 2013 at 4:44pm

|

Yup,You are right on the money Medclinician. ------------- WHAT TO DO???? |

Posted By: Satori

Date Posted: December 26 2013 at 6:03pm

|

Be prepared: Wall Street advisor recommends guns, ammo for protection in collapse http://washingtonexaminer.com/be-prepared-wall-street-advisor-recommends-guns-ammo-for-protection-in-collapse/article/2541205 Is A Financial Apocalypse Coming? http://www.emarotta.com/is-a-financial-apocalypse-coming/ How David Stockman Became Democrats' Favorite Reaganite http://www.theatlantic.com/politics/archive/2012/08/how-david-stockman-became-democrats-favorite-reaganite/261121/ ""I invest in anything that [Federal Reserve Chair Ben] Bernanke can't destroy, including gold, canned beans, bottled water and flashlight batteries." |

Posted By: coyote

Date Posted: December 27 2013 at 3:21am

|

THE STOCK MARKET HAS OFFICIALLY ENTERED CRAZYTOWN TERRITORY It is time to crank up the Looney Tunes theme song because Wall Street has officially entered crazytown territory. Stocks just keep going higher and higher, and at this point what is happening in the stock market does not bear any resemblance to what is going on in the overall economy whatsoever. So how long can this irrational state of affairs possibly continue? Stocks seem to go up no matter what happens. If there is good news, stocks go up. If there is bad news, stocks go up. If there is no news, stocks go up. On Thursday, the day after Christmas, the Dow was up another 122 points to another new all-time record high. In fact, the Dow has had an astonishing 50 record high closes this year. This reminds me of the kind of euphoria that we witnessed during the peak of the housing bubble. At the time, housing prices just kept going higher and higher and everyone rushed to buy before they were "priced out of the market". But we all know how that ended, and this stock market bubble is headed for a similar ending. It is almost as if Wall Street has not learned any lessons from the last two major stock market crashes at all. Just look at Twitter. At the current price, Twitter is supposedly worth 40.7 BILLION dollars. But Twitter is not profitable. It is a seven-year-old company that has never made a single dollar of profit. [link to www.blacklistednews.com] ------------- Long time lurker since day one to Member. |

Posted By: Guests

Date Posted: December 27 2013 at 7:49am

| liquidity pumped the market the euphoria is in the air... good time to sellup |

Posted By: Johnray1

Date Posted: December 27 2013 at 11:06am

|

coyote.you might be right about a market collapse,but I am told that one thing that is keeping the market up and will likely keep the market up is money coming in from other countries. We are on shaky financial ground in this country, but many people forget that the rest of the world is even shaker. Like my friend said,when you look at every thing,we are in really scarey shape,but we are still the most stable economy in the world. The rest of the world leaders know this to. That is really scarey,but it is true. The whole world economy will collapse before ours does,but then we will be the last to go and so many countries and many very rich people from other countries will do all that they can to make sure that we do not collapse.----- Personally,I think the whole world economy will collapse and we will follow,because that is what the plan is for the world. Then with all of the chaos and starving and killing that will follow,the "New World Order" will stop the problems when we get down to 500,000 people world wide,but they have tried this before and the "New World Order" has always failed,but they do manage to get millions of people killed. The "New World Order" will fail again,but millions and possibly billions will die. Johnray1 My advice,buy more beans,wear camo, and stay unseen. |

Posted By: Mahshadin

Date Posted: December 27 2013 at 4:57pm

|

Med your post is three months old (Not exactly imminent) I made almost 20% in that time. I think we should insist that these Doom and Gloom Posts be dated otherwise its just stating the inevitable or Obvious. Tell me something I don't already know. Will the market crash again "absolutely" Its a legalized & glorified Casino Over the years not much has changed when it comes to these Doom & Gloom stories, the stock market is going to crash, the dollar is going to crash, the economy is going to crash, the evil elitist new world order is going to kill you all. The only thing I have seen that actually did happen was the format in which these cons are presented. I remember when they were going door to door with records, then it was cassette tapes, then we got video with beta and vhs, then on to DVD's and now the internet explosion. Now there are information trolls everywhere. Atleast if we held the posts to dating the conversation would be a bit more entertaining and possibly even more factual instead of the repetitive brainwashing that now sells for real information. We could even keep a score card post and find out whose right and who is just (Well You Know) Just my thoughts Piece of advise--Enjoy your life now, anyway you slice it its never long enough. To sit and worry about every crash and burn post or radio show is not worth your time. Besides we have enough to worry about in Pandemic Risks right now!!! ------------- "In a time of universal deceit, telling the truth is a revolutionary act." G Orwell |

Posted By: Medclinician2013

Date Posted: December 28 2013 at 2:03am

Well, when I posted this we were nearing a government shutdown and the market was very jittery. It is true this thread has become too large and after a few more people post, I will let it go to thread heaven. The idea is not to make a resounding prediction and wait until it comes true. ------------- Medclinician - not if but when - original |

Posted By: Guests

Date Posted: December 28 2013 at 7:39am

|

Johnray... America the most stable economy in the world??? LOL America has about 102% debt to GDP ratio (not great). China has 6% GDP to debt ratio. Admittedly GDP is not the best measure of financial well-being, but it paints with a wide brush. What about the halving of all US property values?? What about Detroit bankruptcy?? What about USA's desperate money printing joining the likes of Mugabe's fiscal prowess... Sorry to burst your bubble but America is very unstable. The big collapse that didn't happen may have been averted by the skin of your teeth. Money printing has deleveraged the market , but will the roosters come home to roost? The jury is still out. For now its a booming market and its euphoric!!!! I've made money too!!! yay |

Posted By: Elver

Date Posted: December 28 2013 at 5:25pm

|

I have a 'grap'h of the 1929 through 1931 'stock market crash'. All I can say is that nobody has a crystal ball. Anyone who got out of the market prior to the crash of 1929 thru 31 was better off than those who stayed in. This collapse took about 3 years. Our market is terribly overvalued right now and we're not greedy enough to stay in until the end which is why we've started to taper out of it. Everyone is seeking dividends and stock appreciation since banks don't pay anything, but the risk is pretty large right now. Imagine climbing up in a roller coaster until the crest of the hill is reach whereupon the roller coaster drops suddenly on the other side. Even if you get out prior to the top you will be vastly better off than those who went over the top. |

Posted By: Guests

Date Posted: December 28 2013 at 5:51pm

| I am still waiting for it to crash then I will pick up some stocks! The Treasuries are going up also...good news on all fronts! |

Posted By: Elver

Date Posted: December 29 2013 at 8:31pm

|

Unless your money is under your mattress, you may not have anything left in the bank to invest. By then our dollar may not be worth anything anyway. Lots of people are forecasting bad things to happen in 2014, but this song has been sung before and not much has happened. The bottom is that nobody has a crystal ball on what will happen or when. People have to prepare themselves for several different scenarios. |

Posted By: Guests

Date Posted: December 29 2013 at 9:58pm

|

The really big picture to understand is that by 2016 China will be the largest superpower. This will cut deep into the established power structure of the world. Past investment circles will collapse and new ones in new territories will be born. This massive shift in capital will move along lines chasing new growth. This is just the beginning of a long term transition and is set to last around twenty years. So where are the mega banks going to put their investment dollar? Who's currency will be the world reserve currency? Its obvious OR China and USA have a fight....

|

Posted By: Johnray1

Date Posted: December 29 2013 at 11:07pm

|

cobber, I would much prefer that the US and China go to war. They have a massive Army,but they have no way to get them here and they have to feed them everyday. We sink what few ships that they have and then we just set back and pick them apart. After all, ALL wars have been fought over money.Johnray1 |

Posted By: KiwiMum

Date Posted: December 30 2013 at 11:22am

|

The difference between the Chinese and the rest of the world is they have long term strategies and we all don't. I heard a British radio show talking about China needing to import food because they now have too many people to feed, and they are so clever about it. The Chinese have gone to some of the big farms in the UK and have said "we'll buy all you produce for the next 10 (15, 20 etc) years, and we'll pay you x amount (which is always a good price compared with the supermarkets) and all you have to do is grow and harvest it, we'll pick it up from your farm and take it from there. " The farmers are delighted. It cuts their workload down, it increases their profits and takes away the worry of the price being altered by the supermarket at the last minute, and it guarantees them sales at a good price for years. The trouble is that the British have only just noticed and all of a sudden the farms that supermarkets bullied and relied on are saying "no thanks, we've sold elsewhere". It's predicted to cause a huge rise in the cost of food in the UK. The Chinese have formed similar trade agreements over here in NZ. As I say, the Chinese have long term strategies. In the Western world our politicians only think to the end of their term in office, and no further. ------------- Those who got it wrong, for whatever reason, may feel defensive and retrench into a position that doesn’t accord with the facts. |

Posted By: jacksdad

Date Posted: December 30 2013 at 12:12pm

|

Quite apart from their economy riding high on a housing boom they've manufactured by building cities just to keep their construction industry busy, the Chinese are facing some major problems when their one child policy catches up with them. Even though two children was the norm in rural areas, enough families went with one child (and continue to do so despite the change in the law) that they'll be facing the prospect of a large retired population being supported by a much smaller workforce in a few years. ------------- "Buy it cheap. Stack it deep" "Any community that fails to prepare, with the expectation that the federal government will come to the rescue, will be tragically wrong." Michael Leavitt, HHS Secretary. |

Posted By: Medclinician2013

Date Posted: January 01 2014 at 7:50am

|

http://video.foxnews.com/v/2995270399001/will-2014-end-wall-streets-party/?playlist_id=921261890001 Bust predicted despite Wall Street boom. ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: January 06 2014 at 4:16pm

|

http://abcnews.go.com/Business/wireStory/futures-higher-2014s-full-trading-week-21431833%20 - http://abcnews.go.com/Business/wireStory/futures-higher-2014s-full-trading-week-21431833 Now that the hype is cooling, real numbers are starting to appear. The vote for extension of unemployment has been put off. The Standard & Poor's 500 index notched its worst start to a year in almost a decade Monday, closing lower for the third straight trading day. Although the declines for stocks in the New Year have been modest, the direction has been consistently down. The Standard & Poor's 500 index has fallen 1.2 percent from its most recent record close on Dec. 31. The performance is a contrast to last year, when the S&P 500 surged almost 30 percent, its best annual gain since 1997. The banner year ended with the stock market climbing to record levels amid signs that the economy was strengthening. "The market is basically looking for additional confirmation of economic strength and maybe marking time as it catches its breath from a pretty strong run at year-end," said Jim Russell, a regional investment director at US Bank. The Standard & Poor's 500 fell 4.60 points, or 0.3 percent, to 1,826.77. The Dow Jones industrial average dropped 44.89, or 0.3 percent, to 16,425.10. The Nasdaq composite fell 18.23, or 0.4 percent, to 4,113.68. ------------- Medclinician - not if but when - original |

Posted By: Elver

Date Posted: January 06 2014 at 5:32pm

|

John Williams of Shadowstats.com predicts hyperinflation to start in 2014 and probably sooner rather than later in the year. The 10 year bond yield has been hovering around 3% which I understand to be a bad sign as well. I've been more interested in this 10 year bond yield than I have the DOW lately. |

Posted By: Medclinician2013

Date Posted: January 24 2014 at 11:50am

|

http://blogs.marketwatch.com/thetell/2014/01/24/stock-market-live-blog-another-triple-digit-dive-for-dow-emerging-markets-in-pain/ - http://blogs.marketwatch.com/thetell/2014/01/24/stock-market-live-blog-another-triple-digit-dive-for-dow-emerging-markets-in-pain/ Stock market live blog: Dow drops over 250 points, S&P 500 below key level, Vix climbshttp://www.latimes.com/business/money/la-fi-mo-wall-street-stock-market-down-20140124,0,5058890.story#axzz2rLZOvTNj%20 - http://www.latimes.com/business/money/la-fi-mo-wall-street-stock-market-down-20140124,0,5058890.story#axzz2rLZOvTNj January 24, 2014, 10:13 a.m. NEW YORK -- Stocks faced another broad selloff Friday as investors feared a slowdown in emerging markets and the http://www.latimes.com/topic/economy-business-finance/economy/economic-policy/federal-reserve-ORGOV000035.topic - Federal Reserve 's move to scale back its easy-money policies. The Dow Jones industrial average was down about 200 points in midday trading on Wall Street, following sharp drops in other major stock markets in Europe and Asia. The Dow at one point fell 203.56 points, or 1.3%, to 15,993.79 -- below the psychological milestone of 16,000 the index burst through during an epic rally last year. The broader Standard & Poor's 500 index was off 25 points, or 1.4%, to 1,803.46. The technology-focused Nasdaq composite index was down 65.07, or 1.5%, to 4,153.80. Investors, meanwhile, plowed into U.S. Treasury bonds. The yield on

the benchmark 10-year Treasury fell to 2.74%, off recent highs of around

3%. ------------- Medclinician - not if but when - original |

Posted By: Guests

Date Posted: January 24 2014 at 1:01pm

|

what does this thread have to do with the flu?  confused |

Posted By: Elver

Date Posted: January 24 2014 at 1:45pm

|

The DOW closed down 318 points or 1.96% Lots of people have been forecasting a big drop in the stock market for the first half of 2014. We've tapered down each month for the past 5 months and am glad we did. |

Posted By: jacksdad

Date Posted: January 24 2014 at 2:14pm

Confused - the general discussion section is usually more off topic that the news section, and covers a lot more than just influenza. You have to pick your way through the articles to the ones that interest you. ------------- "Buy it cheap. Stack it deep" "Any community that fails to prepare, with the expectation that the federal government will come to the rescue, will be tragically wrong." Michael Leavitt, HHS Secretary. |

Posted By: Medclinician2013

Date Posted: January 25 2014 at 1:29am

Don't be confused, confused. The economy can have a huge effect on our ability to respond or prepare for a Pandemic. Preparation is a key part of dealing with the Flu. If we have a depression in the midst of a Flu spike, people won''t be able to get adequate health care, they won't have enough money to buy food, and they will become homeless placing them out in the streets during the Flu season. This is like saying - what does an Ice Age or severe cold have to do with the Flu. A lot. This becomes very relevant if you become homeless and the outside temperature with wind chill -30 and you have no job because there are no jobs and companies fail and lay off their employees. No money to pay the rent will make you homeless and no money to buy food will not help if you are infected with a high fever and need liquids and juice to fight the disease. Med ------------- Medclinician - not if but when - original |

Posted By: Technophobe

Date Posted: January 25 2014 at 4:23am

|

I do not know how much it still goes on, but in America's past I believe that hoboes travelled widely across the continent, looking for work. This was largely ignored by the railroad companies who used the mobile labour very cheaply. From the perspective of the virus, those behaviours would be an ideal method of spread. Not only do the disenfranchised need to travel, but the hardships they suffer weaken their imune systems and create superb viral environments. They become a collection of aerosolised petri dishes. The virus does not really care that the hosts have a short lifespan. They are disposable, quickly replaced. ------------- How do you tell if a politician is lying? His lips or pen are moving. |

Posted By: Guests

Date Posted: January 25 2014 at 6:08am

|

Major Viruses and economic collapse go hand in hand. If the economy collapses people get sick. IE People can't access health care, feed themselves and are generally unhealthy etc. If a virus strikes it can have a big effect on the markets. It happened with SARS, Bubonic plague etc This has been debated in the past and its relevant

|

Posted By: coyote

Date Posted: January 29 2014 at 6:17am

|

Med, This may be it!!?? Dow futures tanking! Down 170... ------------- Long time lurker since day one to Member. |

Posted By: coyote

Date Posted: January 29 2014 at 6:19am

|

Business Insider @businessinsider · 2 min The global rally has completely collapsed [link to read.bi] Zerohedge: We can't help but see the irony of this tumult and the possibility of a global financial meltdown occurring on the day of Bernanke's last FOMC meeting... Which is today! ------------- Long time lurker since day one to Member. |

Posted By: coyote

Date Posted: January 29 2014 at 6:26am

|

OBAMA STEP CLOSER TO SEIZING RETIREMENT ACCOUNTS Proposes in SOTU address T-bills for IRA, 401(k) NEW YORK – When you hear, “Hello, I’m from the federal government and I want to help you manage your retirement savings,” the best advice is to run away, as fast as you can. Read more at [link to www.wnd.com] ------------- Long time lurker since day one to Member. |

Posted By: Kilt2

Date Posted: January 29 2014 at 4:21pm

|

We are in a Post Bubble Economy - it is at this time when markets crash and crash and crash. Read Irrational Exuberance by Robert Shiller. http://www.irrationalexuberance.com/ - https://www.google.com.au/search?q=irrational+exuberance&rlz=1C1SKPC_enAU399AU465&oq=irrational+&aqs=chrome.3.69i57j0l5.9807j0j8&sourceid=chrome&espv=210&es_sm=122&ie=UTF-8# -

|

Posted By: hachiban08

Date Posted: February 03 2014 at 9:35am

http://news.yahoo.com/treasury-39-lew-warns-u-default-could-happen-140809355--business.html - http://news.yahoo.com/treasury-39-lew-warns-u-default-could-happen-140809355--business.html Treasury's Lew warns that U.S. default could happen quicklyWASHINGTON (Reuters) - The Obama administration warned on Monday it could start defaulting on the government's obligations "very soon" after it runs out of room to borrow under a legal cap on public debt. After that time, "very soon it would not be possible to meet all of the obligations of the federal government," Lew said at an event hosted by the Bipartisan Policy Center, a prominent Washington think tank. U.S. politicians now partake in a regular dance around the country's so-called debt limit. First, Congress authorizes spending that outstrips tax receipts. Then lawmakers balk over whether to OK enough borrowing to pay the bills. A rancorous debate ensues over putting public finances on a stable path. Washington has danced perilously close to the edge of default several times since 2011, and this year some Republicans pledge to extract policy concessions from Democrats before they allow the debt limit to rise. The administration has vowed not to negotiate on the matter, and Lew said public finances are in good enough shape that long-term fiscal problems don't have to be solved this year anyway. Federal debt ballooned during the 2007-09 recession and most analysts think Washington's obligations to pay for health care for the elderly will stress the budget more as U.S. society ages. But Lew said the sharp reduction in budget deficits over the last few years has bought America time to improve its fiscal outlook. "I'm not sure this is the year for the long-term fiscal challenge to be dealt with," Lew said. "We have a little time to deal with the longer term." It is unclear if Republicans, who are pressing for an overhaul of the government's health care obligations, will put up much of a fight over the debt ceiling. U.S. House Speaker John Boehner, a Republican, said last month American "shouldn't even get close to" default. TAX REFUNDS In October, Congress and the administration suspended a $16.7 trillion cap on borrowing until February 7. If the debt ceiling isn't raised by then, Treasury can juggle money between government accounts for a few weeks to keep just under the new limit. Once it loses the ability to borrow, Treasury would pay its bills by relying on incoming revenue and any cash left in public coffers. No one is sure when the money would run out and lead to missed payments on everything from Social Security pensions to interest on the national debt. Lew said the end of February is a particularly bad time to start relying on a cash cushion. This is because the government at that time is mailing out tax refunds, so the Treasury thinks it would burn through its remaining cash more quickly than it would at other times of the year. Many economists think a U.S. default could trigger a financial panic and perhaps even an economic depression, and Lew urged lawmakers to act swiftly to raise the debt ceiling. "Unnecessary delays or political posturing ... could snowball into a manufactured crisis," he said. (Reporting by Jason Lange; Editing by Andrea Ricci) ------------- Be prepared! It may be time....^_^v |

Posted By: Medclinician2013

Date Posted: March 03 2014 at 9:39pm

|

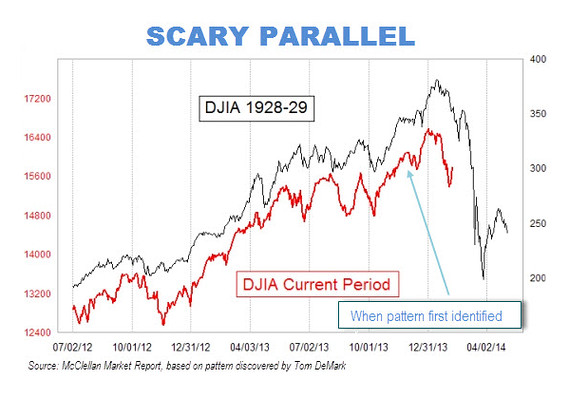

Perhaps through a great deal of manipulation the stock market has survived - but it appears there may be a major crisis coming. http://joecruzmn.wordpress.com/2014/03/03/russian-stocks-crash-as-central-bank-scrambles-war-in-ukraine-a-global-financial-meltdown-and-obamas-planed-economic-war-on-russia/ - https://joecruzmn.wordpress.com/2014/03/03/russian-stocks-crash-as-central-bank-scrambles-war-in-ukraine-a-global-financial-meltdown-and-obamas-planed-economic-war-on-russia/ THE DAILY BEAST: UPDATE: The Associated Press reported Monday that Russia is already suffering some economic consequences of its aggression in Ukraine. The Russian stock market is down 12 percent, the ruble is falling, and the Russian central bank has hiked interest rates in an attempt to shore up the value of its currency. Behind the scenes, Obama administration officials are preparing a series of possible battle plans for a potential economic assault on Russia in response to its invasion of Ukraine, an administration source close to the issue told The Daily Beast. Among the possible targets for these financial attacks: everyone from high-ranking Russian military officials to government leaders to top businessmen to Russian speaking separatists in Ukraine. It’s all part of the work to prepare an executive order now under consideration at the Obama administration’s highest levelsThe question is- if we freeze Russian asset in American or implement harsh sanctions how will that effect the U.S. stock market? A SCARY 1929 PARALLEL, UKRAINE ON THE VERGE OF COLLAPSE, AND YELLEN SAYS THAT CONDITIONS FACING ECONOMY EXTREMELY UNUSUAL.MARKETWATCH.COM: There are eerie parallels between the stock market’s

recent behavior and how it behaved right before the 1929 crash.

comment: creepy wouldn't you say? The pattern which proceeded the crash of 1929 seems to be running a mirror image of what is happening now. conclusion: The economy is like a fine watch with intricate gears and something that should be protected. The current administration seems to have an approach of gathering a handful of dust and slowly putting it in the open watch just to see what happens. A desperate Russia is not a compliant Russia. First we say that Putin is a foreign policy guru and to help us in Syria and now as we appear to be so weak in foreign policy that that China is making land grabs, and Russia is going the same. Our response - sanctions are unlikely to do it - and if they do, the backlash may cause our own economy to stumble and follow that nasty curve above downward. We are floating in the air on a bubble of nothing and if any large bank crashes, 300 others may follow. This is not going to take months. Is a crash imminent? It is a lot more imminent than when I started this thread. Watching and waiting. Medclinician http://rt.com/business/ukraine-default-fitch-downgrade-386/ - ------------- Medclinician - not if but when - original |

Posted By: Medclinician2013

Date Posted: October 09 2014 at 2:22pm

|

Not if but when... http://www.foxbusiness.com/markets/2014/10/09/wall-street-follows-rally-with-steep-selloff/ - http://www.foxbusiness.com/markets/2014/10/09/wall-street-follows-rally-with-steep-selloff/ Stocks continued a volatile run Thursday as concerns over global growth ignited a sharp selloff. Today’s Markets The Dow Jones Industrial Average shed 334 points, or 2%, to 16659, the S&P 500 dropped 40.7 points, or 2.1%, to 1928, and the Nasdaq Composite fell 90.3 points, or 2%, to 4378. Wall Street has been on a see-saw in recent weeks. On Tuesday, the

Dow lost 272 points amid jitters over economic growth in Europe and

elsewhere. The market bounced back a day later, with the Dow posting its

biggest gain of the year, when the Federal Reserve indicated it would

take global struggles into On Thursday, concerns over global “The fear factor is beginning to hit panic levels as worries about a

worldwide economic slowdown become real, despite round after round of

stimulus and central bank intervention,” Todd M. Schoenberger, president

of J. Streicher Asset Management, said in Medclinician Perhaps no as imminent as some once thought- it is unlikely either a Pandemic or War is going to do much for the stock market. ------------- Medclinician - not if but when - original |

Posted By: Dutch Josh

Date Posted: October 10 2014 at 6:40am

|

http://www.zerohedge.com/news/2014-10-09/last-time-it-was-crazy-stock-market-crashed - http://www.zerohedge.com/news/2014-10-09/last-time-it-was-crazy-stock-market-crashed I understand that central banks are running out of tricks to keep the stock-markets going. Q.E. Abenomics have made shares to bubbles. What goes up must come down, and not only in the US ! ------------- We cannot solve our problems with the same thinking we used when we created them. ~Albert Einstein |

Posted By: Medclinician2013

Date Posted: August 20 2015 at 6:46am

|

This is not a new theme - and the possible collapse of the U.S. stock market has been coming for a long time. When I first predicted this I was told it could not happen but as the world economy looks bad and wall street is not at all healthy- it is possible. ------------- Medclinician - not if but when - original |

Posted By: Medclinician

Date Posted: August 20 2015 at 6:55am

|

http://thesovereigninvestor.com/exclusives/stocks-economy-on-verge-of-collapse/?z=389596%20 - http://thesovereigninvestor.com/exclusives/stocks-economy-on-verge-of-collapse/?z=389596 August 14, 2015 Several noted economists and distinguished investors are warning of a 50% stock market crash. Billionaire Carl Icahn, for example, recently threw up a red flag on national broadcast when he declared, “The public is walking into a trap again as they did in 2007.” Unfortunately, Icahn’s warning is tame compared to his peers. “U.S. stocks are now about 80% overvalued,” says Andrew Smithers, the chairman of Smithers & Co. He backs up his prediction using a ratio which proves that the only time in history stocks were this risky was 1929 and 1999. And we all know what happened next. Stocks fell by 89% and 50%, respectively. Former congressman Ron Paul didn’t mince words either. He warns that the stock market’s “day of reckoning” is fast-approaching. When that day comes, he doesn’t think it’s just going to be a correction, it will be “stock market chaos.” But there is one distinct warning that should send chills down your spine … that of James Dale Davidson. As a renowned economist, best-selling author, and founder of Strategic Investment, Davidson makes the strongest case for a looming crisis — “Right now, there are three key economic indicators screaming SELL. They don’t imply that a 50% collapse is looming, it’s already at our doorstep.” However, it’s not just a 50% stock market collapse that Davidson is warning about. He also predicts that “real estate will plummet by 40%, savings accounts will lose 30%, and unemployment will triple.” (To see Davidson’s research behind these predictions, http://pro1.strategicinvestment.com/389596 -People are not confident in the way things are and are not prepared for this. Our money is invested heavily outside the U.S. and in ways with the current trade deficit and debt ceiling high above what it should be, we are living on a dollar that is floating in the air. Eventually, things must correct themselves. We cannot continue to support all of the social programs, retirement, social security, and the huge drain as our borders have failed to control immigration. Those who ignore history, are doomed to repeat it. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: August 20 2015 at 3:06pm

|

http://www.foxbusiness.com/economy-policy/2015/08/20/futures-slump-as-investors-continue-to-parse-fed-minutes/?intcmp=hplnws%20 - http://www.foxbusiness.com/economy-policy/2015/08/20/futures-slump-as-investors-continue-to-parse-fed-minutes/?intcmp=hplnws Global-growth concerns with the backdrop of the Fed’s latest meeting minutes ignited a selloff on Wall Street Thursday as U.S. stocks followed global markets lower. The Dow Jones Industrial Average sank 358 points, or 2.06% to 169901. The S&P 500 shed 43 points, or 2.10% to 2035, while the Nasdaq Composite plunged 141 points, or 2.82% to 4877. All ten S&P 500 sectors were in negative territory as consumer discretionary lead the way. The sector plunged 2.80% to close the session. Today’s Markets Wall Street suffered steep losses amid a global market selloff as the Dow fell below the psychologically-significant 17000 mark, and the lowest level since October 30. Traders in the U.S. fretted about global growth and what a slowdown could mean for the Federal Reserve’s decision about when to begin hiking short-term interest rates. Media and social stocks were slammed during the session as big names in the space including Disney ( http://quote.foxbusiness.com/symbol/DIS/snapshot - DIS ), Time Warner ( http://quote.foxbusiness.com/symbol/TWX/snapshot - TWX ), and Twitter ( http://quote.foxbusiness.com/symbol/TWTR/snapshot - TWTR ) came under intense selling pressure on the back of a downgrade for Disney and Time Warner to “market perform” from “outperform” from Bernstein thanks to a decline in ad revenue. http://www.foxbusiness.com/technology/2015/08/20/twitter-sinks-below-ipo-price/ - Twitter shares plunged 6%, falling to a new all-time low of $25.92, that’s below the company’s $26 IPO price. Volume on the session was about 7% above the one-month average. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: August 21 2015 at 1:50pm

http://www.foxbusiness.com/markets/2015/08/21/stocks-eye-reprieve-despite-mortal-blow-from-chinese-data/?intcmp=hpbt3%20 - http://www.foxbusiness.com/markets/2015/08/21/stocks-eye-reprieve-despite-mortal-blow-from-chinese-data/?intcmp=hpbt3  Wall Street plunged for a second-straight day, forcing all three major U.S. averages to give up their 2015 gains and causing the Dow to easily enter correction territory. The Dow Jones Industrial Average tumbled 530 points, or 3.11% to 16462. The S&P 500 shed 64 points, or 3.17% to 1971, while the Nasdaq plunged 171 points, or 3.52% to 4706. Technology and energy stocks took the biggest hit during the session, with the respective sectors dropping 4.21% and 3.48%. Medclinician comment: One can hope this is only a correctional slide that will stop and right itself as stocks have become over valued and also are reacting to the impact of a possible world economic crash including China and Japan. We are so immersed with a huge trade deficit, a soaring unbalanced national debt, and political instability, that regulating and protecting the market is outdistancing simply raising or lowering interest rates. ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: August 22 2015 at 8:08am

|

http://www.profitconfidential.com/stock-market/stock-market-crash/%20 - http://www.profitconfidential.com/stock-market/stock-market-crash/ Remember, stock markets are only as strong as the companies within them. On the surface, all looks well, but it isn’t. That’s because the U.S. economy, while improving, is extremely vulnerable. So maybe the idea of a major stock market collapse or correction in 2015 isn’t that big of a stretch. The U.S. unemployment rate may have slipped below the six-percent threshold, but a large number of Americans—roughly 12%—remain underemployed.( http://www.bls.gov/news.release/empsit.t15.htm - 1 ) Wages have been flat and, perhaps not coincidently, approximately 15% of the U.S. population is on food stamps.( http://www.fns.usda.gov/sites/default/files/pd/34SNAPmonthly.pdf - 2 ) Personal spending may be accelerating, but so too are debt levels. We may be spending, but we aren’t paying with cash. As the world’s biggest economy and largest consumer market, 71% of the country’s gross domestic product (GDP) came from consumer spending in 2013. All things considered, this is not a recipe for sustainable growth. http://www.profitconfidential.com/economic-analysis/upcoming-stock-market-crash/ - http://www.profitconfidential.com/economic-analysis/upcoming-stock-market-crash/ Despite the stock market’s record run and Washington’s assurances that the economy is getting better, some of America’s wealthiest billionaires aren’t convinced. In fact, their recent actions suggest some sort of market crash is on its way. Do they know something you don’t? Not really. The data is out there for everyone to see. Unfortunately, Wall Street is too busy ignoring the warning signs. The stock market is supposed to be a reflection of the economy, but right now, it isn’t. That’s because most Americans aren’t even aware we’re in the midst of a recovery. Not unlike the stock market, the U.S. economy looks good on paper. The U.S. unemployment rate is under six percent, interest rates are low, and the economy is picking up steam.( http://www.bls.gov/news.release/empsit.t15.htm - 4 ) Dig a little deeper, though, and you’ll discover that the underemployment rate is still at an unacceptable 12%, wages are stagnant, personal debt levels are high, and 15% of Americans are on food stamps. Plus, most Americans (76%) are still living paycheck to paycheck.( http://www.cbsnews.com/news/shocking-number-of-americans-have-no-retirement-savings/ - 5 ) For the world’s biggest economy, these are not the makings of an economic recovery. Nor are they the foundation for sustainable economic growth, especially when you consider the fact that the U.S. gets more than 70% of its gross domestic product (GDP) from consumer spending. This might explain why some of the country’s wealthiest investors are dumping certain U.S. stocks. comment: I know Albert is on this and making a prediction of a world wide economic crash. I have been at this for more than a year watching a struggling and sick economy in which reports are heavily weighed to continue to predict improvement while behind the scenes many danger signals are present. No one wants this to happen - especially globally. We simple do not have the executive or congressional power in place to deal with it. This Monday will tell us a lot. Past being present - there will be a massive correction and the media will be flooded with "how very wrong" it was to predict trouble and now things are fine. Whatever happens - they are not fine. The unemployment rates in no way reflects the real unemployment which may be double since they don't even count non-voters or people not looking for work. Most of all this is not a time to be right about this. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: August 24 2015 at 6:53am

|

http://www.foxbusiness.com/markets/2015/08/24/wall-street-set-to-plunge-amid-global-market-selloff/%20?intcmp=hpbt1%20 - http://www.foxbusiness.com/markets/2015/08/24/wall-street-set-to-plunge-amid-global-market-selloff/?intcmp=hpbt1 Global economic-growth fears slammed Wall Street on Monday as U.S. equity markets plunged. As of 9:30 a.m. ET, Dow Jones Industrial Average futures tumbled 657 points, or 3.99 % to 15808. S&P 500 futures dropped 74 points, or 3.78 % to 1897, while Nasdaq 100 futures plunged 208 points, or 4.96% to 3992. Today’s Markets The Dow saw its biggest-ever intraday point drop on Monday at the opening bell as it plunged 1,089 points. At the start of trading, all three major U.S. averages fell deep into correction territory. A weekend to digest growing global economic-growth concerns failed to settle nerves on Wall Street as U.S. equities took a nosedive one session after the Dow officially entered a correction. Wall Street extended a selloff in global equity markets as worries about significant deterioration in China sparked fear in the minds of investors around the world. comment: We are seeing a meltdown on Wall Street. The Dow dropped 1,089 points today. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Satori

Date Posted: August 24 2015 at 6:55am

|

Panic!! All Major US Equity Indices Halted |

Posted By: Medclinician

Date Posted: August 24 2015 at 1:10pm

------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: August 24 2015 at 1:28pm

|

http://money.cnn.com/data/us_markets/%20 - http://money.cnn.com/data/us_markets/ Most of my focus has been tracking a possible United States market crash for the last two years. The ripple effect from a dismal Chinese stock market and other world economy issues are making it worse. Medclinician http://money.cnn.com/data/us_markets/%20 - ------------- "not if but when" the original Medclinician |

Posted By: CRS, DrPH

Date Posted: August 24 2015 at 9:56pm

...my investments in Smith & Wesson look better all the time!  ------------- CRS, DrPH |

Posted By: Medclinician

Date Posted: August 25 2015 at 2:07pm

|

http://money.cnn.com/2015/08/25/investing/stocks-markets-china-turnaround-tuesday/index.html%20 - http://money.cnn.com/2015/08/25/investing/stocks-markets-china-turnaround-tuesday/index.html Things are not better. A 442-point surge for the http://money.cnn.com/data/markets/dow/?iid=EL - Dow vanished at the end of the trading session Tuesday, the latest sign of how anxious markets have become about the health of the global economy. At the end of yet another wild day of trading,

the Dow actually ended with a loss of 205 points as fears continued to

mount over China's slowing economy and its contagion effect on the rest

of the world. Just in the last six trading days, the Dow has lost a

total of nearly 1,900 points, or 11%. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: August 27 2015 at 10:21am

|

http://www.telegraph.co.uk/finance/economics/7259323/US-bank-lending-falls-at-fastest-rate-in-history.html%20 - http://www.telegraph.co.uk/finance/economics/7259323/US-bank-lending-falls-at-fastest-rate-in-history.html Thursday 27 August 2015 Bank lending in the US has contracted so far this year at the fastest rate in recorded history, raising concerns that the Federal Reserve may have jumped the gun by withdrawing emergency stimulus. Fed chair Ben Bernanke first made his name as an expert on the "credit channel" causes of slumps. It is unclear why he has been so relaxed about declining bank loans this time. "The

reason the Great Depression became 'great' was the contraction of

credit. You would have thought that a student of the Depression like

Bernanke would be alarmed by this," said Mr Ashworth. Medclinician note: No problems have been solved in the U.S. economy or in the basic over-valuing of stock at 1/70. We approach a likely meltdown of not only the U.S. but world economy in either September or October. Fault or blame is not an issue but rather the reality of a situation which demands correction and it will happen. ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: September 01 2015 at 7:13am

|

http://www.foxbusiness.com/markets/2015/09/01/china-growth-fears-slam-us-stock-futures-sharply-lower/?intcmp=fnhpfbc - http://www.foxbusiness.com/markets/2015/09/01/china-growth-fears-slam-us-stock-futures-sharply-lower/?intcmp=fnhpfbc Wall Street kicked off September on a sharply negative note as China growth worries slammed global markets yet again. As of 9:30 a.m. ET, the Dow Jones Industrial Average plunged 324 points, or 1.92% to 16196. The S&P 500 sank 36 points, or 1.85% to 1935, while the Nasdaq Composite dropped 94 points, or 1.96% to 4683. All ten S&P 500 sectors were in negative territory, with technology falling the most, 2.20% in recent action. Today’s Markets It’s déjà vu all over again for global financial markets as manufacturing data rule the day. Overnight, data from China showed the nation’s manufacturing sector slipped to a three-year low and back into contraction territory for the first time in six months, though mostly in-line with expectations, while the services sector also showed weakness. comment: After tracking this for years it is continuing to play out and could lead to a stock market crash. ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: September 04 2015 at 8:42am

|

comment: It is possible that the U.S. stock market will crash in September - October 2015. Some are predicting a global collapse of stocks beginning on October 7, 2015. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: September 14 2015 at 9:27am

|

http://money.cnn.com/data/markets/ - http://money.cnn.com/data/markets/ The stock market continues to be bad. Most of the people I have talked to predict a major correction or collapse in September - October. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: September 19 2015 at 12:51pm

|

http://www.thestreet.com/topic/47781/stock-market-today.html - http://www.thestreet.com/topic/47781/stock-market-today.html

16,384.58

-289.95 (-1.74%)

4:20 PM

ET 09/18/15

It is possible we will see a 15,000 DJIA? http://www.thestreet.com/story/13292187/1/the-stock-market-is-headed-for-a-big-decline-here-s-why.html?kval=dontmiss - Moves on stock markets were erratic after Thursday's announcement. The S&P 500 dipped into negative territory, then soared 1%, before returning to the red. The Dow Jones Industrial Average fell 0.13%, and the Nasdaq gained 0.18%. The Volatility S&P 500 ( http://www.thestreet.com/quote/VIX.X.html - VIX.X http://www.thestreet.com/quote/VIX.X.html - |

Posted By: Medclinician

Date Posted: September 29 2015 at 6:00am

|

Stocks keep heading downwards. We may be headed for a 15,000 DOW before this is over or worse. http://money.cnn.com/data/markets/ - http://money.cnn.com/data/markets/

http://secure.marketwatch.com/tools/marketsummary/ - https://secure.marketwatch.com/tools/marketsummary/ There could be some real upsets during October as there are more bad announcement on lending rates and also the national deficit and debt. Medclinician ------------- "not if but when" the original Medclinician |

Posted By: Medclinician

Date Posted: January 04 2016 at 1:14pm

|

I brought this thread back up and am getting ready to start new one for 2016. The market is looking worse. Medclinician ------------- "not if but when" the original Medclinician |

Albert wrote:

Albert wrote: